Xoilac TV là trang xem bóng đá được biết đến với rất nhiều ưu điểm nổi bật. Điều này mang đến cho người xem bóng đá những trải nghiệm tuyệt vời, đỉnh cao.

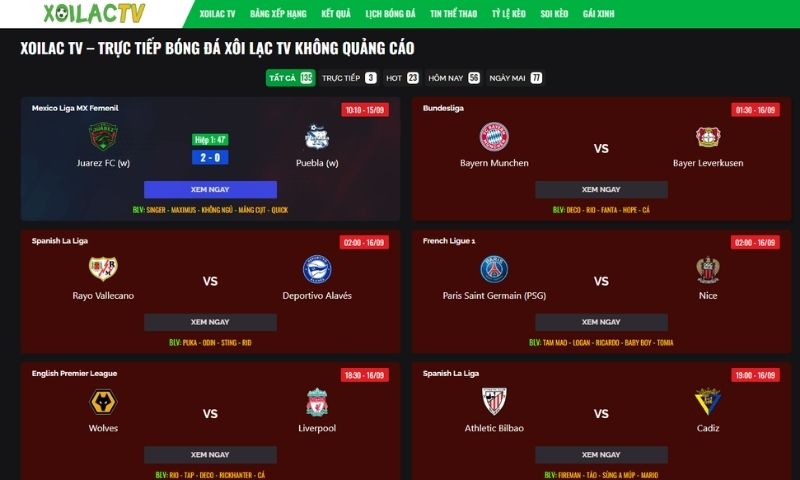

Lịch trực tiếp hôm nay tại alarmingnews.com

Xoilactv được biết đến là trang web xem trực tiếp bóng đá không chèn quảng cáo, hoàn toàn miễn phí với chất lượng full HD cực đỉnh. Với những ưu điểm tuyệt vời đó, kênh xem bóng đá này được đông đảo người xem yêu thích, lựa chọn. Để tìm hiểu rõ hơn về trang web này, mọi người hãy theo dõi những chia sẻ cụ thể dưới đây.

Giới thiệu đôi nét thông tin về kênh xoilactv

Hiện nay tại Việt Nam, ngày càng ít người lựa chọn phương thức xem bóng đá trên truyền hình. Điều này xuất phát từ sự thuận tiện khi xem bóng đá qua kênh trực tiếp, theo đó mọi người có thể dễ dàng tiếp cận phương thức này hơn. Chính vì vậy, đã xuất hiện nhiều trang web cung cấp dịch vụ xem bóng đá trực tuyến trong đó có xoilactv.

Xoilactv là gì?

Xoilactv là địa chỉ trang web không thể bỏ qua đối với những ai yêu thích bóng đá ở Việt Nam. Được biết đến là trang web hàng đầu về bóng đá trực tuyến, kênh không chỉ mang đến trải nghiệm xem bóng đá trực tiếp chất lượng cao, bình luận tiếng Việt miễn phí… mà còn tạo nên cộng đồng đam mê lớn với xoilactv.

Bên cạnh việc cung cấp dịch vụ xem trực tiếp, xoilactv còn là nguồn thông tin bóng đá đáng tin cậy, nhiều tin tức bổ ích hàng ngày. Trong các trang web phát sóng bóng đá trực tuyến tại Việt Nam, xoilactv được đánh giá cao và lựa chọn nhiều nhất. Kênh tự hào khi đã giữ vững danh tiếng từ thời điểm xuất hiện trên thị trường.

Hiện nay, xoilactv là một cái tên không còn xa lạ với những người yêu thể thao. Bởi lẽ đây là nơi phát sóng đầy đủ tất cả các giải đấu bóng đá lớn trong, ngoài nước. Giúp người xem dễ dàng tìm kiếm, theo dõi trực tiếp các trận đấu mình quan tâm thuận lợi và hoàn toàn miễn phí.

Mục tiêu phát triển xoilactv

Với sự đầu tư bền vững về tài chính, xoilactv không ngừng phấn đấu để trở thành trang web trực tiếp bóng đá hàng đầu. Mục tiêu của kênh là mang đến cho khán giả những trận đấu bóng đá hấp dẫn với chất lượng hình ảnh tốt nhất. Sau nhiều năm công việc kiên trì và phát triển, kênh đã “gặt hái” một phần quan trọng của mục tiêu đề ra.

Điều này được chứng minh bằng sự thu hút hàng chục nghìn lượt truy cập mỗi ngày từ cộng đồng người hâm mộ. Xoilactv đã trở thành điểm đến hàng đầu cho những người yêu thích xem trực tiếp các trận đấu bóng đá mà họ đặc biệt quan tâm.

Đánh giá ưu điểm vượt trội của kênh xem bóng xoilactv

Rất nhiều cuộc khảo sát đã được thực hiện, hầu hết người dùng đều đánh giá vô cùng hài lòng khi trải nghiệm tại xoilactv. Thật tự hào khi xoilactv đã nhận được sự tín nhiệm từ người dùng, và đó cũng là nhờ vào những ưu điểm nổi bật mà kênh mang lại.

Thiết kế giao diện xoilactv chuyên nghiệp, đẹp mắt

Để đặt nền tảng cho việc này thông qua việc thăm dò ý kiến từ đông đảo người dùng Việt. Đảm bảo rằng trang web được xây dựng để phục vụ cho nhu cầu, thị hiếu của mọi người. Thế nên, khi bước chân vào xoilactv, mọi người sẽ bị cuốn hút bởi giao diện trang web với sự thiết kế thông minh.

Màu sắc trang web được chúng tôi lựa chọn một cách tỉ mỉ, hài hòa để làm nổi bật những tính năng quan trọng. Các chuyên mục được phân chia rõ ràng thành nhiều mục con như trận đấu nổi bật, lịch thi đấu, nhận định chuyên gia… Từ đó giúp mọi người tìm kiếm thông tin nhanh chóng, dễ dàng hơn mà không gây mệt mỏi cho đôi mắt.

Xoilactv khác biệt với các trang web xem bóng đá khác ở chỗ tích hợp banner quảng cáo hài hòa tại trang chủ. Hợp tác với những đối tác uy tín, đặt banner ở những vị trí tối ưu, không gây ảnh hưởng lớn đến trải nghiệm sử dụng. Cam kết không làm phiền lòng người xem bằng cách chèn quá nhiều quảng cáo.

Xem bóng đá trực tiếp tại xoilac tv chất lượng cao

Tất nhiên, với một trang web hàng đầu trong việc phát sóng trực tiếp bóng đá như xoilactv, chất lượng luôn được đặt lên hàng đầu. Cụ thể, hãy cùng liệt kê những ưu điểm vượt trội về chất lượng mà kênh mang lại như sau:

- Liên tục cập nhật đường link xem bóng đá từ rất sớm, mỗi trận đấu đều có ít nhất 3 link để đảm bảo sự linh hoạt cho người xem. Cam kết rằng đường link không chứa mã độc hay virus, giữ cho trải nghiệm của mọi người an toàn, mượt mà nhất.

- Hình ảnh trong các trận đấu được truyền tải với độ phân giải Full HD, đảm bảo sự sắc nét và chân thực. Âm thanh sống động, kích thước màn hình đảm bảo đúng chuẩn, tạo nên trải nghiệm xem trực tiếp bóng đá tuyệt vời.

- Cung cấp tính năng tùy chỉnh cho phép người xem điều chỉnh âm lượng, kích thước màn hình, và độ phân giải sao cho phù hợp nhất. Nhằm tối ưu hóa trải nghiệm xem bóng đá theo cách cá nhân hóa và thoải mái nhất.

Xoilactv trực tiếp bóng đá tốc độ cao và mượt mà

Xoilactv đang áp dụng công nghệ đường truyền tiên tiến, giúp tất cả các trận đấu được phát sóng với tốc độ ổn định, mượt mà. Điều này mang đến cho anh em những trải nghiệm xem trực tiếp bóng đá không thua kém gì việc ngồi trước màn hình TV.

Khi tốc độ truyền tải ổn định và mượt mà, những vấn đề như giật lag, đứng hình hay mất kết nối dường như không xuất hiện. Nếu có, mọi người chỉ cần dừng lại vài giây rồi tiếp tục trận đấu mà không gặp phải những trục trặc không mong muốn.

Đội ngũ bình luận viên xoilactv sôi động, lôi cuốn

Không thể nhắc đến xoilactv, chúng ta không thể không nhắc đến đội ngũ bình luận viên đặc sắc của kênh. Các trận đấu bóng đá trực tuyến trên kênh đều được bình luận chất lượng bằng tiếng Việt. Họ không chỉ cuốn hút mà còn tạo ra không khí sống động, khiến mỗi trận đấu trở nên hấp dẫn hơn rất nhiều.

Ngoài ra, đội ngũ BLV của kênh không chỉ chuyên nghiệp mà còn thân thiện và vui vẻ. Họ thường tương tác với người xem trong suốt quá trình trận đấu diễn ra, tạo nên trải nghiệm xem trực tiếp bóng đá thú vị.

Không chèn quảng cáo, gây phiền hà cho người xem

Xoilactv luôn xem trọng trải nghiệm của người dùng nên việc chèn quảng cáo trong lúc diễn ra trận đấu là không bao giờ xảy ra. Kênh cam kết rằng, mọi người gần như sẽ không bao giờ gặp phải banner, video quảng cáo, hoặc các cửa sổ quảng cáo độc hại.

Hiện tại, kênh chỉ hiển thị banner quảng cáo cho các nhà cái lớn trên trang chủ nhằm hỗ trợ nguồn thu nhập để duy trì, nâng cấp trang web. Tất nhiên, nếu mọi người cảm thấy bị quấy rối thì có thể tắt chúng bất kỳ lúc nào theo mong muốn của mình.

Hướng dẫn mọi người cách xem bóng đá trực tiếp tại xoilactv

Việc xem trực tiếp bóng đá tại xoilactv không yêu cầu người xem phải đăng ký tài khoản trên nền tảng. Tuy nhiên, để có những trải nghiệm trọn vẹn đầy đủ các tính năng, anh em nên đăng ký tài khoản người dùng. Việc xem bóng đá tại kênh của chúng tôi là hoàn toàn miễn phí nên anh em có thể hoàn toàn yên tâm.

- Bước 1: Cần đảm bảo mọi người đã sở hữu một thiết bị kết nối Internet như điện thoại thông minh, máy tính bàn, laptop, hoặc máy tính bảng.

- Bước 2: Truy cập trình duyệt web, nhập từ khóa xoilactv trên thanh công cụ tìm kiếm. Nhấn vào đường link chính thức của nhà cái, lưu ý tình trạng lừa đảo hiện nay khác phổ biến.

- Bước 3: Quan sát tại giao diện chính của nhà cái, mọi người hãy nhấn chọn mục Đăng ký. Sau đó, anh em hãy thực hiện theo hướng dẫn để tạo tài khoản người dùng thành công.

- Bước 3: Khi trang web xoilactv hiển thị, mọi người có thể tự do truy cập thông tin, các trận đấu bóng mà mình muốn theo dõi.

Kết luận

Như vậy, qua bài viết mọi thắc mắc của anh em về kênh xoilactv chắc hẳn đã được có lời giải rồi đúng không nào. Còn chần chừ gì mà không nhanh chóng tham gia kênh xem bóng để tận hưởng những những trận đấu đỉnh cao. Nếu còn bất kỳ thắc mắc nào, đừng ngần ngại hãy để lại bình luận bên dưới, chúng tôi sẽ hỗ trợ ngay